Taking control of your finances can seem daunting, but it doesn't have to be. With a little effort and the right knowledge, you can establish a solid foundation for financial well-being. This guide will provide you with the essential tools to handle your money effectively, achieve your financial goals, and secure a brighter future.

First, it's crucial to formulate a budget that tracks your income and expenses. This will give you a clear understanding of where your money is going and reveal areas where you can minimize costs. Once you have a stable grasp on your spending habits, you can start to consider different investment options that align with your risk tolerance and financial objectives.

Remember, unique circumstances vary, so it's important to seek advice a financial advisor if you need personalized guidance.

Gaining Financial Freedom Through Budgeting

Taking control over your finances can seem challenging, but it doesn't have to be. Your well-planned budget is the foundation to meeting your financial objectives. First monitoring your income and expenses for several weeks. This will show you where your money is spent.

- When you have a clear understanding of your spending habits, it's time to create a budget that allocates your money effectively.

- Establish achievable financial goals, like saving for retirement, settling off debt, or buying a property.

- Analyze your budget frequently and make modifications as needed. Events can change, so it's important to maintain your budget flexible.

Investing for Success: Boost Your Wealth Smartly

Embark on a journey to financial freedom by utilizing smart investment strategies. A well-diversified portfolio can minimize risk while achieving returns. Consult a qualified financial expert to structure a personalized plan aligned with your goals. Regularly monitor your holdings and modify as needed to stay on track for long-term prosperity.

- Evaluate different asset allocation such as stocks, bonds, and real estate.

- Manage volatility across various markets to minimize loss.

- Keep abreast of market movements to make calculated decisions.

Debt Management Strategies: Get Back on Track handle

Feeling overwhelmed by debt can be a stressful experience, but it's important to remember that you're not alone. Quite a few people struggle with debt at some point in their lives. The good news is that there are effective debt management strategies you can employ to regain control of your finances and strive for financial stability. A key first step is to create a budget that accurately reflects your income and expenses. This will help you identify areas where you can cut back spending and free up more cash flow to direct towards debt repayment.

- Another beneficial strategy is to consolidate your debts into a single loan with a lower interest rate. This can ease your monthly payments and potentially save you money on interest charges over time.

- Converse with your creditors to see if they are willing to reduce your interest rates or forgive late fees. Being proactive about your financial situation can often lead to positive outcomes.

- Considering professional guidance from a credit counselor or debt management agency can also be instrumental. They can provide personalized advice, help you develop a feasible repayment plan, and support you throughout the process.

Remember, getting back on track financially is a journey that takes time and commitment. By implementing these debt management strategies, you can create positive changes, minimize your stress levels, and work towards a brighter financial future.

Saving Secrets

Your financial future is a valuable asset, and safeguarding your secrets is paramount in building a secure tomorrow. Start by establishing a budget that monitors your income and expenses thoroughly. This provides a clear picture of your financial situation. Consider diversifying your investments across multiple asset classes to minimize risk and maximize potential returns. Furthermore, regularly review your financial plan and make adjustments as appropriate to maintain it with your evolving goals.

- Examine your credit report regularly.

- Encrypt sensitive financial information on your devices and online accounts.

- Engage professional advice from a certified financial planner to create a personalized strategy.

Financial Literacy: Empower Yourself with Knowledge

Taking control of your finances is a challenge. However, achieving financial success doesn't have to get more info be overwhelming. A critical step is building your financial literacy—grasping how money works and choosing wisely. By investing in personal finance, you set the stage for a more secure and fulfilling future.

- Begin your journey by learning the basics

- Track your spending habits

- Create a budget that aligns with your goals

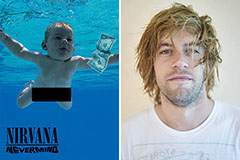

Spencer Elden Then & Now!

Spencer Elden Then & Now! Daniel Stern Then & Now!

Daniel Stern Then & Now! Matilda Ledger Then & Now!

Matilda Ledger Then & Now! Mary Beth McDonough Then & Now!

Mary Beth McDonough Then & Now! Andrew McCarthy Then & Now!

Andrew McCarthy Then & Now!